We have talked about the blockchain in prior articles. Many people associate the "blockchain" with "Bitcoin" but the blockchain is far more than Bitcoin. Bitcoin is a counter financial cyclical innovation that arose directly after and as a result of the 2007/8 financial crash and depression. We refer to it here as counter-cyclical because it has a deflationary monetary supply built into the code. It is not subject to human, governmental or political motivations that can inflate the money supply to unprecedented levels of indebtedness - in a monetary experiment - that devalues the worth of the currency, causes inevitable inflation and arguably impacts those who are the least well off, the most, over the mid to long term. Bitcoin's supply is fixed and known. It is finite. It is often referred to as a "store of value" - the equivalent of digital gold, except more easily stored on a comparative basis, more liquid and transportable, not to mention an increasingly globally accepted currency and asset class in the westernized world.

We have talked about the blockchain in prior articles. Many people associate the "blockchain" with "Bitcoin" but the blockchain is far more than Bitcoin. Bitcoin is a counter financial cyclical innovation that arose directly after and as a result of the 2007/8 financial crash and depression. We refer to it here as counter-cyclical because it has a deflationary monetary supply built into the code. It is not subject to human, governmental or political motivations that can inflate the money supply to unprecedented levels of indebtedness - in a monetary experiment - that devalues the worth of the currency, causes inevitable inflation and arguably impacts those who are the least well off, the most, over the mid to long term. Bitcoin's supply is fixed and known. It is finite. It is often referred to as a "store of value" - the equivalent of digital gold, except more easily stored on a comparative basis, more liquid and transportable, not to mention an increasingly globally accepted currency and asset class in the westernized world.

Bitcoin is however just the tip of the iceberg of changes and innovations spurred by the blockchain that will sweep the world and impact every industry on the planet. The biggest disruption in finance in the last two hundred years is unfolding now. It will be commonplace soon to be able to send monies for free or fractions of a cent 24/7 to anyone in the world. Businesses will be able to accept payments for cents vs paying 2-4% in fees for every sale. Individuals can access fair market interest rates in exchange for depositing monies with crypto banks. You can do that right now. Yes, these do carry more risk but with over $250 billion dollars accessing the decentralized financial markets today these risks will become more manageable. Insurance products are already being created to manage this risk. This industry is still in its early evolutionary phase and as the products and technology mature so will the ease of use, accessibility and safety.

Another industry that is being reinvented on the blockchain is the gaming industry. In one year, Axie Infinity, a blockchain gaming company is generating more revenue than some of the largest gaming companies in the world. More, many more such ventures are coming. The economics or tokenomics of these ventures allows users to also interact financially whether it is to secure the network, purchase games, buy/sell various items within the gaming ecosystems, compete and generate income.

...

We first want to wish all our readers and clients a Happy New Year!

We first want to wish all our readers and clients a Happy New Year!

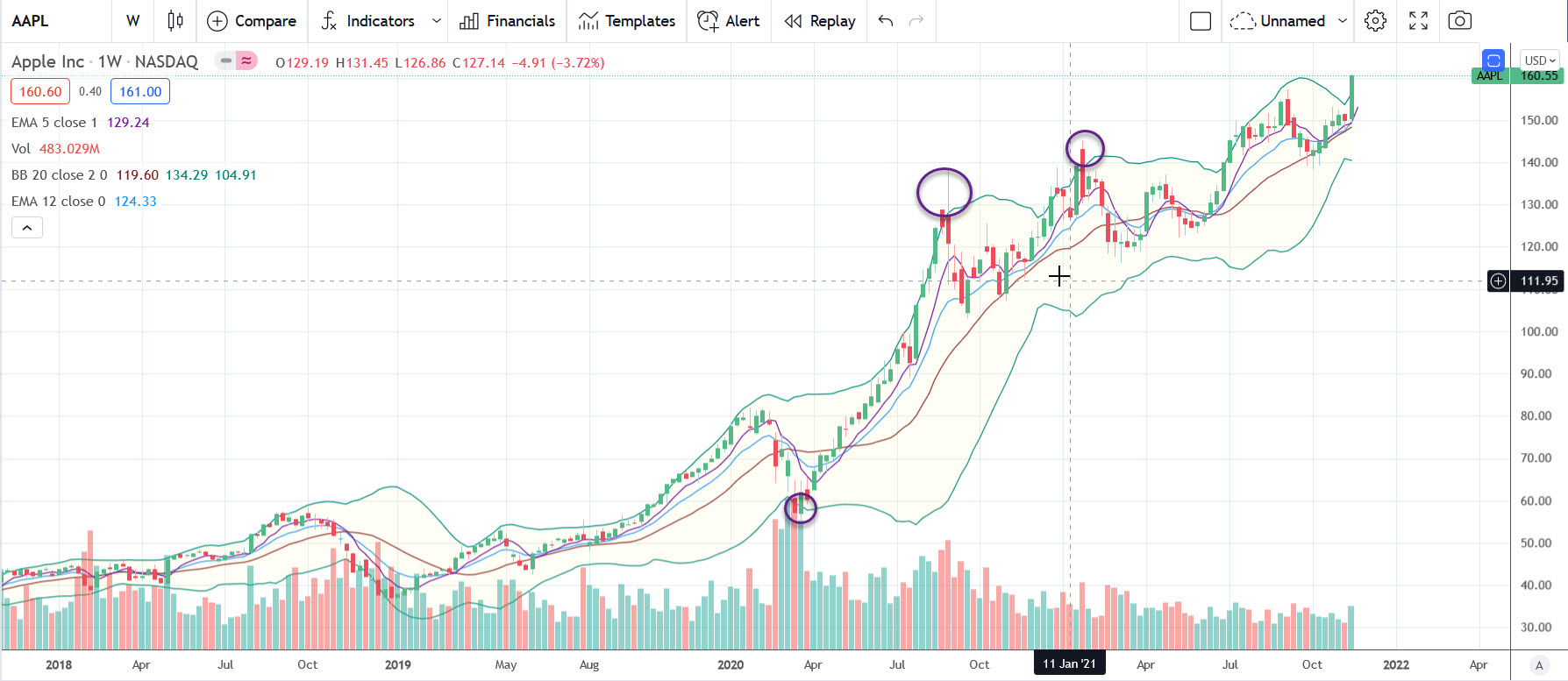

What the heck are Bollinger Bands?

What the heck are Bollinger Bands? Some bad news for Democrats in Virginia prompted some much needed urgency and positive action on the legislative front and the resulting upgrading of America's deteriorating infrastructure. The "Build Back Better" or $1.2 Trillion Infrastructure Bill passed through Congress yesterday and is now waiting to be signed into law by the President.

Some bad news for Democrats in Virginia prompted some much needed urgency and positive action on the legislative front and the resulting upgrading of America's deteriorating infrastructure. The "Build Back Better" or $1.2 Trillion Infrastructure Bill passed through Congress yesterday and is now waiting to be signed into law by the President. We have often written about the "asset inflation" bubble caused by a trifecta of near zero interest rates, record levels of money printing not seen in american history and the federal reserve acting as a backstop for everything! Well maybe not everything, but again more than ever before. The "relative value" of the dollar continues to fall against this backdrop. a trend that has continued over a 50+ year period. The purchasing power of the dollar has fallen by 92% over the last 50 years. Let that sink in for a moment. The only saving grace is that other westernized countries are not faring much better yet none have the size of national debt of the USA. It helps to be the worlds reserve currency!

We have often written about the "asset inflation" bubble caused by a trifecta of near zero interest rates, record levels of money printing not seen in american history and the federal reserve acting as a backstop for everything! Well maybe not everything, but again more than ever before. The "relative value" of the dollar continues to fall against this backdrop. a trend that has continued over a 50+ year period. The purchasing power of the dollar has fallen by 92% over the last 50 years. Let that sink in for a moment. The only saving grace is that other westernized countries are not faring much better yet none have the size of national debt of the USA. It helps to be the worlds reserve currency! We have talked about the blockchain in prior articles. Many people associate the "blockchain" with "Bitcoin" but the blockchain is far more than Bitcoin. Bitcoin is a counter financial cyclical innovation that arose directly after and as a result of the 2007/8 financial crash and depression. We refer to it here as counter-cyclical because it has a deflationary monetary supply built into the code. It is not subject to human, governmental or political motivations that can inflate the money supply to unprecedented levels of indebtedness - in a monetary experiment - that devalues the worth of the currency, causes inevitable inflation and arguably impacts those who are the least well off, the most, over the mid to long term. Bitcoin's supply is fixed and known. It is finite. It is often referred to as a "store of value" - the equivalent of digital gold, except more easily stored on a comparative basis, more liquid and transportable, not to mention an increasingly globally accepted currency and asset class in the westernized world.

We have talked about the blockchain in prior articles. Many people associate the "blockchain" with "Bitcoin" but the blockchain is far more than Bitcoin. Bitcoin is a counter financial cyclical innovation that arose directly after and as a result of the 2007/8 financial crash and depression. We refer to it here as counter-cyclical because it has a deflationary monetary supply built into the code. It is not subject to human, governmental or political motivations that can inflate the money supply to unprecedented levels of indebtedness - in a monetary experiment - that devalues the worth of the currency, causes inevitable inflation and arguably impacts those who are the least well off, the most, over the mid to long term. Bitcoin's supply is fixed and known. It is finite. It is often referred to as a "store of value" - the equivalent of digital gold, except more easily stored on a comparative basis, more liquid and transportable, not to mention an increasingly globally accepted currency and asset class in the westernized world.