When markets fall, who do you listen to? This may seem like an odd title for a blog post, but it is an important one from a pyschological, health and financial well being standpoint. When markets fall and the economy experiences a down turn, the mainstream media highlights worst case scenarios and how bad everything can get. It can make your stomach churn if you have money in the markets, even if you have gone through such events in the past. The media is highly trained on how to illicit response with headlines that make you want to read them. That is how they make their money. It is also built into human pyschology that any danger signals trigger the pre-historic or primordial functions of the brain that are about survival. Add a terrible war in Ukraine and ongoing economic cold-war with China and you have a recipe for doom and gloom.

When markets fall, who do you listen to? This may seem like an odd title for a blog post, but it is an important one from a pyschological, health and financial well being standpoint. When markets fall and the economy experiences a down turn, the mainstream media highlights worst case scenarios and how bad everything can get. It can make your stomach churn if you have money in the markets, even if you have gone through such events in the past. The media is highly trained on how to illicit response with headlines that make you want to read them. That is how they make their money. It is also built into human pyschology that any danger signals trigger the pre-historic or primordial functions of the brain that are about survival. Add a terrible war in Ukraine and ongoing economic cold-war with China and you have a recipe for doom and gloom.

Reading the daily media headlines can be bad for your health. As Baron Rothchild once said "Buy when there is blood in the streets". That is of course much harder to do for the very reasons we are just referencing. Our brains and bodies are trained to "flee" danger, and not walk into it for good reason!

Who do you listen to or turn to when markets are falling is an important question. When you have a professional seasoned financial advisor, you have an objective party to speak with who can share their perspectives about bear and bull markets over decades of experience. When you are in the midst of a bear market, it seems like it will never end. Likewise when you are in a bull market it seems like it will never end. Both statements are false however. No Bull or Bear market is permanent.

...

The speed at which the economy has nose-dived from optimism to pessimism has taken a lot of people by surprise. That's the impact the Federal Reserve can have on the markets. Consumer confidence is fickle so when the daily news is filled with fears of recession and declining markets it impacts people in a way that causes people to spend less: The Nasdaq is down over 31% from it's highs and this along with all the media headlines of "recession" is generating a more fearful and less optimistic mood.

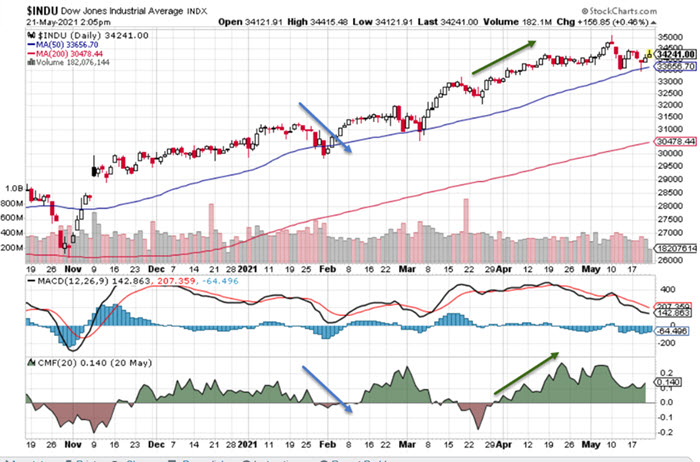

The speed at which the economy has nose-dived from optimism to pessimism has taken a lot of people by surprise. That's the impact the Federal Reserve can have on the markets. Consumer confidence is fickle so when the daily news is filled with fears of recession and declining markets it impacts people in a way that causes people to spend less: The Nasdaq is down over 31% from it's highs and this along with all the media headlines of "recession" is generating a more fearful and less optimistic mood. There is a whole lot of Chaikin going on! In todays blog post we are continuing the series about technical analysis and the large toolbox of indicators available. Today we are looking at an indicator that attempts to measure money flows into and out of a security.

There is a whole lot of Chaikin going on! In todays blog post we are continuing the series about technical analysis and the large toolbox of indicators available. Today we are looking at an indicator that attempts to measure money flows into and out of a security. China has issued a digital Yuan and it's got governments around the world scared and in catch-up mode. So what's the big deal? The world is moving at breakneck pace to a digital based currency system. Cash is being phased out. Consumers around the world are paying increasingly with debit and credit cards. Cash is being used less and less and this trend has only accellerated since the advent of COVID. It only makes sense in a predominantly digital commerce world that this would be accompanied by government issued digital currencies.

China has issued a digital Yuan and it's got governments around the world scared and in catch-up mode. So what's the big deal? The world is moving at breakneck pace to a digital based currency system. Cash is being phased out. Consumers around the world are paying increasingly with debit and credit cards. Cash is being used less and less and this trend has only accellerated since the advent of COVID. It only makes sense in a predominantly digital commerce world that this would be accompanied by government issued digital currencies.