Omicron and Inflation are the boogeymen out to spoil the Holiday Season. Should you let them?

Omicron and Inflation are the boogeymen out to spoil the Holiday Season. Should you let them?

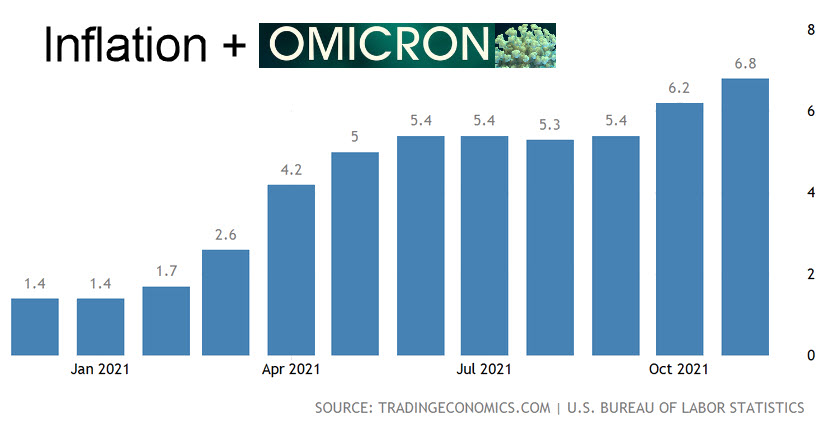

Markets are souring as news of record inflation numbers rebound across the globe alongside the emergence of a markedly different strain of the coronavirus out of South Africa. Wall Street is worried about the potential severity and impact of Omicron on the economy and how it may stall a potential recovery. The inflation concern is principally tied to worries regarding potential hikes in interest rates in 2022 and their impact on valuations and the stock market altogether.

These are real concerns. The question is how "real" and the answer to both of these issues is "unknown" at this juncture. The studies on Omicron and the efficacy of the various vaccines to thwart or limit it are still in process. Initial reports suggest that the impact of Omicron is less mild disease than the current Delta variants, but it is simply too early to tell if this is true. Markets are waiting for scientifically backed data and news.

Inflation is not as transitory as the Feral Reserve intitially believed. It is widespread across the entire economy. Companies are raising prices across all sectors as supply shortages and a supply/demand imbalance inevitably force prices up! Inflationary pressures are likely to continue in the short term. The BIG question is whether prices and supply/demand push inflation will stabilize. We believe the answer to this question is "yes", the unknown is "when". We think that supply will eventually catch up with demand and prices will stabilize and in some cases adjust downwards. However, with wages pushing higher everywhere due to widespread labor shortages we do not see prices on the whole coming down in many sectors, but rather stabilizing.

Timing matters. The longer that supply/demand imbalances do not reach a point of equilibrium across many market sectors, the more likely the Federal Reserve will hike rates and this in turn will act as a catayst for further market reverberations and uncertainties. In the event the market achieves greater supply/demand equilibrium sooner, the Fed will taper but may not need to raise interest rates. In this scenario more certainty returns to the markets and that can set the stage for a renewed growth or "recovery" cycle.

As we have mentioned in previous blog posts, the convergence of AI, Biotech, Super Computing, new material sciences, Blockchain, Web 3, 5G technology and so much more, has the potential to fuel an industrial boom on a widespread global scale unlike any other in history.

A worst case scenario sees prolonged inflation and supply/demand imbalances followed by rate hikes until inflation is curbed and greater supply/demand equilibrium is achieved with the Federal Reserve possibly then lowering rates and ushering in a return to a new growth and "recovery" cycle narrative.