With so much talk in the news of day traders and investors, we thought it would be useful to discuss whether the allure and excitement of short term trading outweighs the more boring strategy of long term investing. On the surface, day trading or short term trading appears to be a relatively easy way to make money. With Tesla and Apple and other tech stocks posting such enormous gains in a relatively short time frame, what is so complicated about doing that?

With so much talk in the news of day traders and investors, we thought it would be useful to discuss whether the allure and excitement of short term trading outweighs the more boring strategy of long term investing. On the surface, day trading or short term trading appears to be a relatively easy way to make money. With Tesla and Apple and other tech stocks posting such enormous gains in a relatively short time frame, what is so complicated about doing that?

The reality is that timing the markets and individual stocks in the short term is very challenging for the professional traders with all the tools and technology at their disposal, which makes the odds of success even more stacked against non-professional short term traders. There are periods in time where short term trading strategies can work swimmingly but this this is not the case over the long term.

It is well documented that in general for the most part, buy and hold investors often outperform short term traders (after tax and other costs are factored in) by 6-7% per annum. There are always a small number of day or short -term trader success stories that are promoted by the media of course, but the reality is that over the long term most day or short term traders are not successful and eventually lose money.

We defer to the wisdom of one of the most successful fund managers of all time, Charlie Munger co-founder of Berkshire Hathaway: "The BIG MONEY is not in the buying or selling, but in the WAITING". Think about this quote for a moment and consider the implications.

To make significant money you need to be invested in the highest quality stocks with big potential for growth but then you need to have paitience and wait for these companies to realize their potential. Stocks inevitably osscilate based on a myriad of complex factors.

To try to trade these fluctuations is a professional traders game that has been made infinitely more complex by trading bots and algorithms. There is no need to do so if you are looking to succeed in making money. In addition, investing for the long term comes with significant tax benefits, a lower capital gains tax rate.

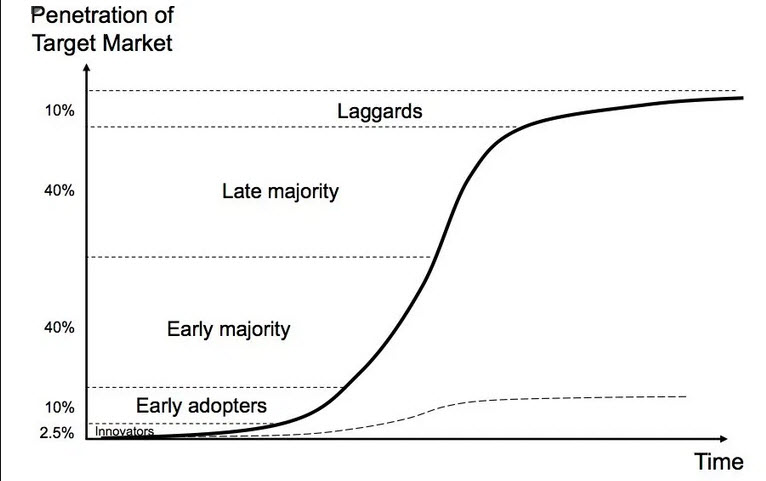

There is another very compelling argument for investing over the long term and that is the technology S-Curve of adoption. New technology or ideas go through a predictable S-Curve with respect to their adoption. The initial phase of adoption is undertaken by the early adopters, the enthusiasts and believers.

It is unclear at this stage whether the idea or technology will be adopted by the mainstream and this phase therefore marks the highest risk. This phase can last a long time. As an idea or technology gains traction it slowly makes its way to a point where adoption rates reach approximately 10% of the market. The distance or time from 10% adoption to 90% is a steep rise within a relatively short time frame of say 5-10 years.

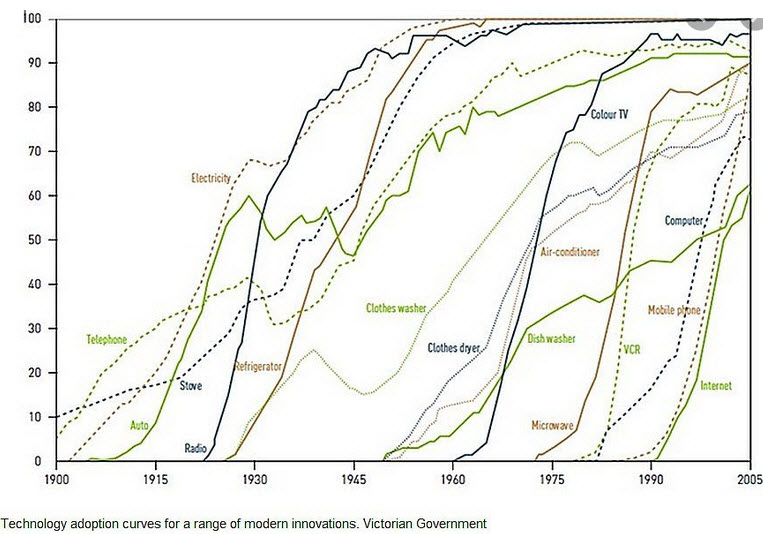

If you look at various examples below of technology innovations and their adoption cycle you can see the same pattern "S-Curve" unfolding in every case and accellerating over time as technology has accellerated the means to spread new ideas.

Companies at the leading edge of each of these S-Curves stood to gain enormously as the shift in the S-Curve from 10% to 90% market share adoption took place. That time frame may have been 10-25 years in the earlier part of the 20th Century but now can be as little as 10 years. Look at the adoption rates of the color tv, the computer, internet and mobile phone vs. the telephone or electricity in the early parts of the twentieth century.

This predictable pattern alongside the other points made in this article underscore why investing over the long term is how, in the words of Charlie Munder, the Big Money is made. It is in the waiting!

Investing is in some respects simple yet also complex. Every individual and family has a unique situation. When it comes to survival, people can at times get irrational about money and investing. Having an independent advisor at your side can make the journey a lot less stressful as well as more productive and objective.