Inflation numbers continue to be the central issue shaping the market narrative. Last week’s market rally is based on the "not yet substantiated" narrative that inflation numbers will come down sooner and will necessitate less drastic action on the part of the Federal Reserve. In the short term, it's a speculative narrative.

Inflation numbers continue to be the central issue shaping the market narrative. Last week’s market rally is based on the "not yet substantiated" narrative that inflation numbers will come down sooner and will necessitate less drastic action on the part of the Federal Reserve. In the short term, it's a speculative narrative.

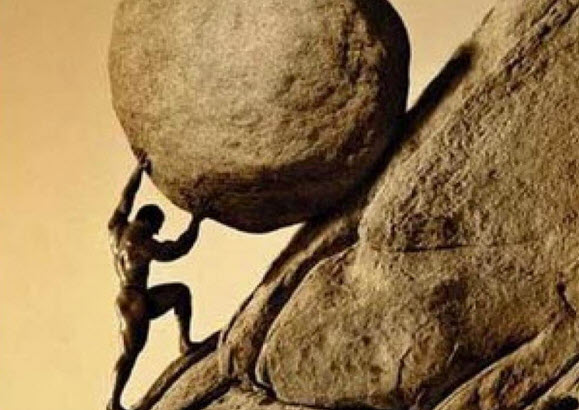

The markets are forward looking so speculation is inevitably a component of how markets operate. However, the real determining factor will be the hard inflation numbers. Is inflation trending downwards? To answer this question will take several consecutive months of declining data to validate. Until such time, the Federal Reserve has no incentive - after miscalculating this issue through 2021 - to operate less hawkishly. Its credibility is on the line. As a result, they will look to declining inflation numbers over several consecutive months until they lighten their rhetoric and along with it, rate hikes. Until then, the Federal Reserve has no reason to veer off its already communicated path of more aggressive interest rate hikes.

The daily question and commentary that is in the news headlines - whether we will see a recession or not - is largely dependent on the still "unknown" question of "how long" it will take to bring inflation down and "how high do rates need to go for that to occurr"?

Until all this becomes more of a "known" the potential for surprises on this "front" will be a subject that is ripe for inducing more market turbulence.

If you are a market participant over the long term the short term direction is less important than the market trend over the long term. The odds of taming inflation are high. It's just a matter of how much economic pain needs to be inflicted to achieve that end. Once that end is closer to being realized the Federal Reserve will look to strike a balance to ensure for an environment that is conducive for growth while keeping "inflation" at more acceptable levels which it has stated is 2% per annum.

How much of a market downturn has already been priced in by the market? Many stocks on the Nasdaq are down substantially from their November 21 highs. That being said any new negative surprises can provoke "fears" that may "worsen sentiment" and drive markets further down as "recovery models" and "timelines" are re-calibrated.

Over the long term, markets have passed through world wars, economic recessions, oil price shocks and more always to move higher. Planning for retirement and income needs in retirement requires analysis and wealth management experience that is customized to your personal situation, age and goals. We invite you to book a complimentary appointment to discuss your goals.